Business Insurance in and around Guilford

Searching for protection for your business? Search no further than State Farm agent Craig Tracz!

No funny business here

- Branford, CT

- Madison, CT

- North Branford, CT

- Clinton, CT

- New Haven County CT

- Middlesex County CT

Your Search For Great Small Business Insurance Ends Now.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Craig Tracz help you learn about quality business insurance.

Searching for protection for your business? Search no further than State Farm agent Craig Tracz!

No funny business here

Insurance Designed For Small Business

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is temporarily closed. It not only protects your take-home pay, but also helps with regular payroll overhead. You can also include liability, which is key coverage protecting your business in the event of a claim or judgment against you by a customer.

Reach out to State Farm agent Craig Tracz today to check out how a State Farm small business policy can ease your worries about the future here in Guilford, CT.

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

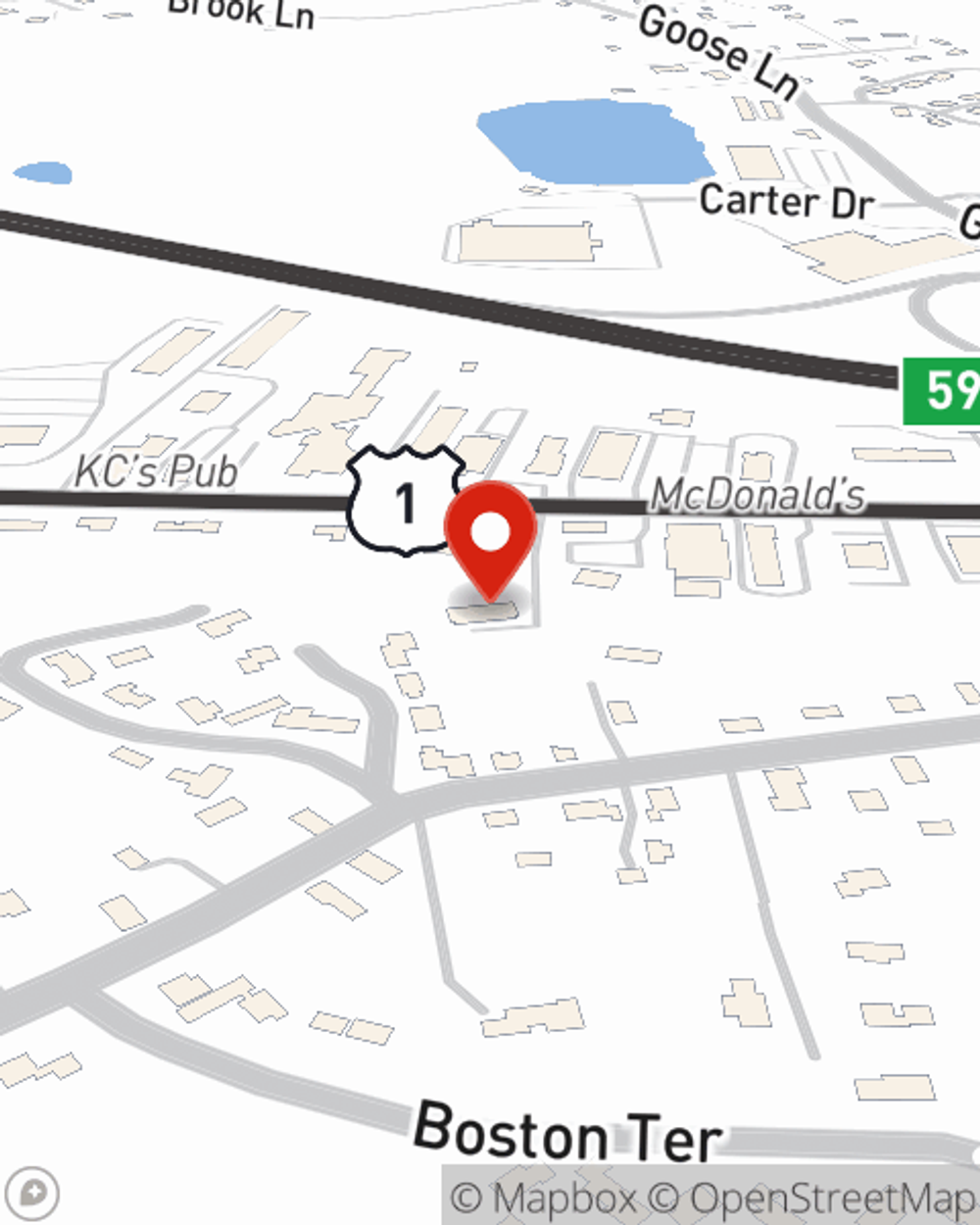

Craig Tracz

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.