Life Insurance in and around Guilford

Get insured for what matters to you

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Branford, CT

- Madison, CT

- North Branford, CT

- Clinton, CT

- New Haven County CT

- Middlesex County CT

It's Time To Think Life Insurance

Investing in those you love is a big responsibility. You listen to their concerns go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Get insured for what matters to you

Life happens. Don't wait.

Put Those Worries To Rest

Fortunately, State Farm offers several policy choices that can be personalized to correspond with the needs of those you love and their unique situation. Agent Craig Tracz has the personal attention and service you're looking for to help you settle upon a policy which can aid your loved ones in the wake of loss.

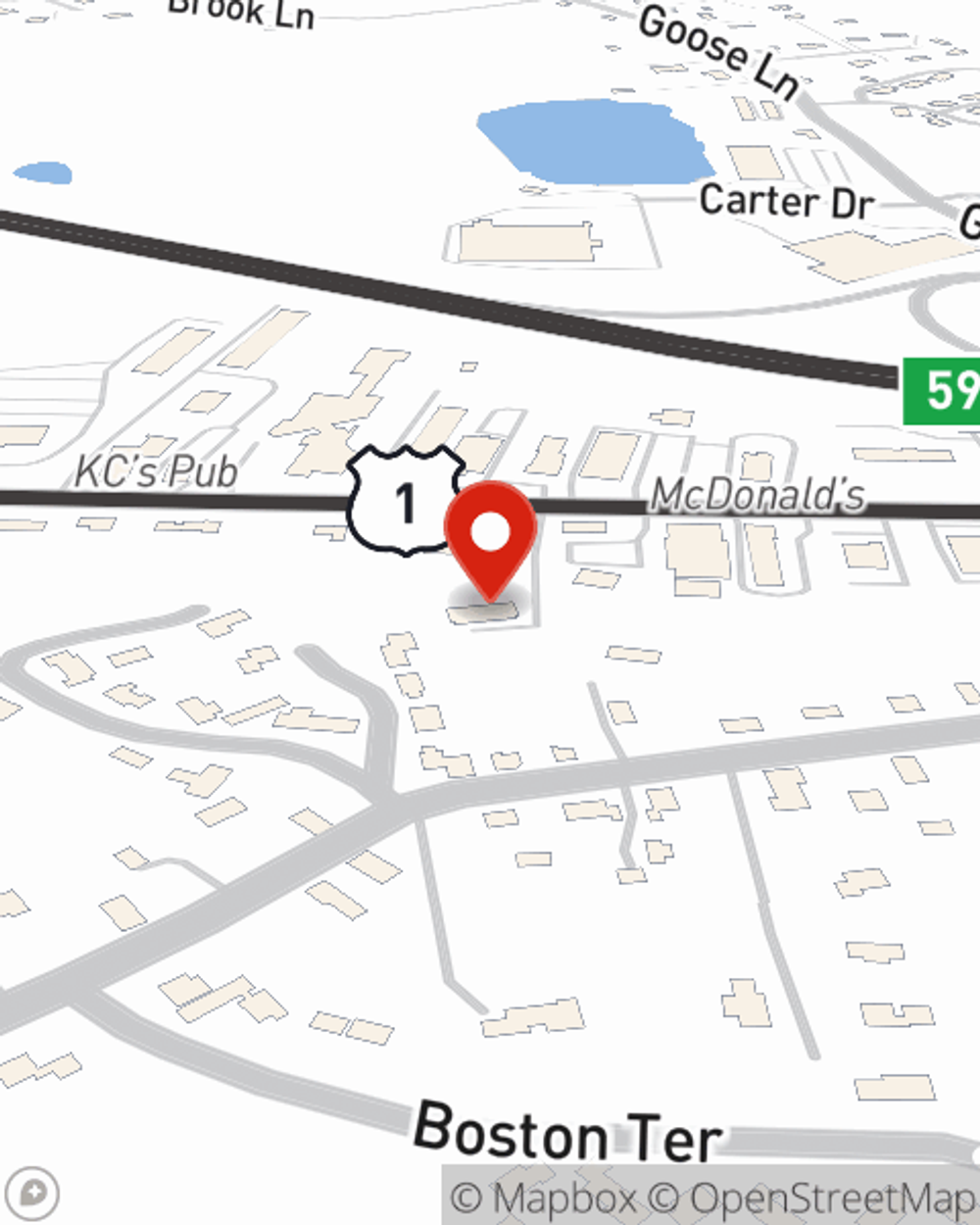

Simply contact State Farm agent Craig Tracz's office today to see how the State Farm brand can help cover your loved ones.

Have More Questions About Life Insurance?

Call Craig at (203) 204-1421 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Craig Tracz

State Farm® Insurance AgentSimple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.